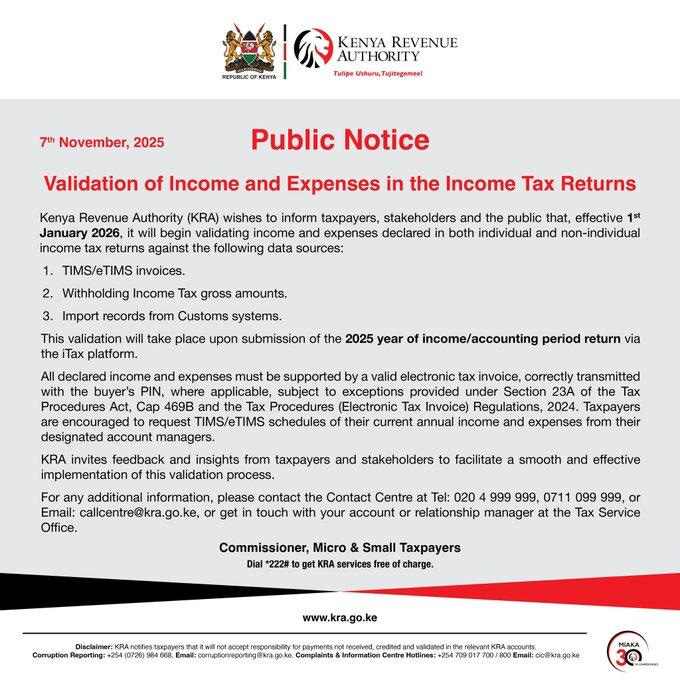

KRA's Public notice on validation of income and expenses in the income tax return.

What It Means for Your Business, Your Books, and Your Ability to Claim Expenses

The Kenya Revenue Authority (KRA) has announced a significant shift in its tax compliance strategy. On 7 November 2025, KRA issued a public notice informing taxpayers and the public that it will begin validating income and expenses declared in both individual and non-individual income tax returns to ensure compliance with TIMS/eTIMS invoices, withholding income tax and import records from the customs systems

This initiative will begin effective from 1 January 2026, and will apply to the submission of the 2025 year of income/accounting period returns via the iTax platform. According to the Income Tax Act, the accounting period for individuals is December, therefore meaning that all expenses incurred by individuals, partnerships and sole proprietors in 2025 will need to be TIMS/eTIMS compliant. For entities with a year-end other than December, their year of income shall be considered to be the accounting year end. For example, if a company has a February year end, then their 2025 year of income will culminate on 28 February 2025. Based on this rationale, entities will need to ensure compliance with these compliance requirements moving back 12 months for the ascertained period of validation by KRA.

The validation process is designed to cross-reference taxpayer submissions against a range of data sources to ensure accuracy and compliance. This move is widely seen as an effort to tighten control over tax evasion.

Key Validation Data Sources

KRA will validate declared income and expenses against the following data points:

TIMS/eTIMS invoices – effective from 1 January 2024, the Tax Procedures Act required all taxpayers to ensure that their expenses are compliant with eTIMS. There are specific exemptions including emoluments, interest, fees charged by financial institution, air ticketing and supplies from non-residents. All other expenses deducted to arrive at the corporate income tax payable should be compliant with TIMS/eTIMS. All declared income and expenses must be supported by a valid electronic tax invoice, correctly transmitted with the buyer’s PIN where applicable, subject to exceptions provided above. Taxpayers are encouraged to proactively request TIMS/eTIMS compliant invoices for their expenses and issue eTIMS compliant invoices to their customers.

Withholding Income Tax gross amounts – all amounts withheld through the withholding tax regime will need to be declared as taxable income by the supplier of the service. For example, doctor fees withheld at 5% will need to be declared in the iTax return of that doctor including the total taxable income which is to be taxed at the individual graduated tax bands.

Import records from Customs systems – all import records need to ensure they reflect the correct tax status and PIN of the taxpayer with all discrepancies explained accordingly

Industry Feedback and Implementation

The KRA has invited feedback and insights from taxpayers and stakeholders to facilitate a smooth and effective implementation of this validation process. The new data-driven compliance approach has generated discussion within the tax community, with some experts noting that over half of businesses utilizing the eTIMS system are already experiencing hurdles. There have also been calls for the scope of exceptions to be expanded.

Resultantly, taxpayers can provide comments through the KRA Contact Centre or get in touch with their account or relationship manager at a Tax Service Office.

How DigiTax Helps Businesses Stay eTIMS-Compliant Under KRA’s New Validation Mandate

With KRA set to validate all declared income and expenses against TIMS/eTIMS invoices starting January 2026, businesses need to ensure that every transaction is properly documented, compliant, and easily auditable. DigiTax provides a simple, automated solutions to achieve full eTIMS compliance.

1. Issue eTIMS-Compliant Invoices Effortlessly

DigiTax allows businesses to generate eTIMS invoices automatically for every sale. Each invoice includes the buyer’s PIN where required and is transmitted to KRA in real time. This ensures that all sales are ready for validation, minimizing risk of rejected declarations.

2. Validate Supplier Expenses Against eTIMS Requirements

Businesses can capture and validate supplier invoices to ensure they meet eTIMS standards. DigiTax ensures that invoices are accurate, complete, and linked to the correct PIN, helping businesses confidently claim legitimate expenses.

3. Integrate Seamlessly With Accounting Systems

Whether you use Quickbooks, Odoo, Sage, WooCommerce, Xero, or other systems, DigiTax integrates directly, allowing your sales and expense records to flow automatically into your accounting system and stay fully eTIMS-compliant.

4. Simplify KRA Validation and Audit Readiness

DigiTax gives businesses a centralized dashboard with full visibility of all transactions, making it easy to track sales, expenses, and eTIMS invoices in real time. Users can generate comprehensive reports for any period, quickly pulling data for iTax submissions or KRA audits. This ensures that businesses can respond to queries accurately and efficiently, with all records organized, secure, and audit-ready.

Why It Matters

With KRA’s new validation applying to the full 2025 year of income, ensuring every invoice is eTIMS-compliant is no longer optional—it’s mandatory. DigiTax gives businesses a solutions such as an intuitive dashboard, API’s for system to system integration and a POS enabled Android app to manage compliance efficiently, reduce errors, and avoid penalties.

To get ahead of this mandate with DigiTax, email info@namiri.tech or call/whatsapp 0112685368